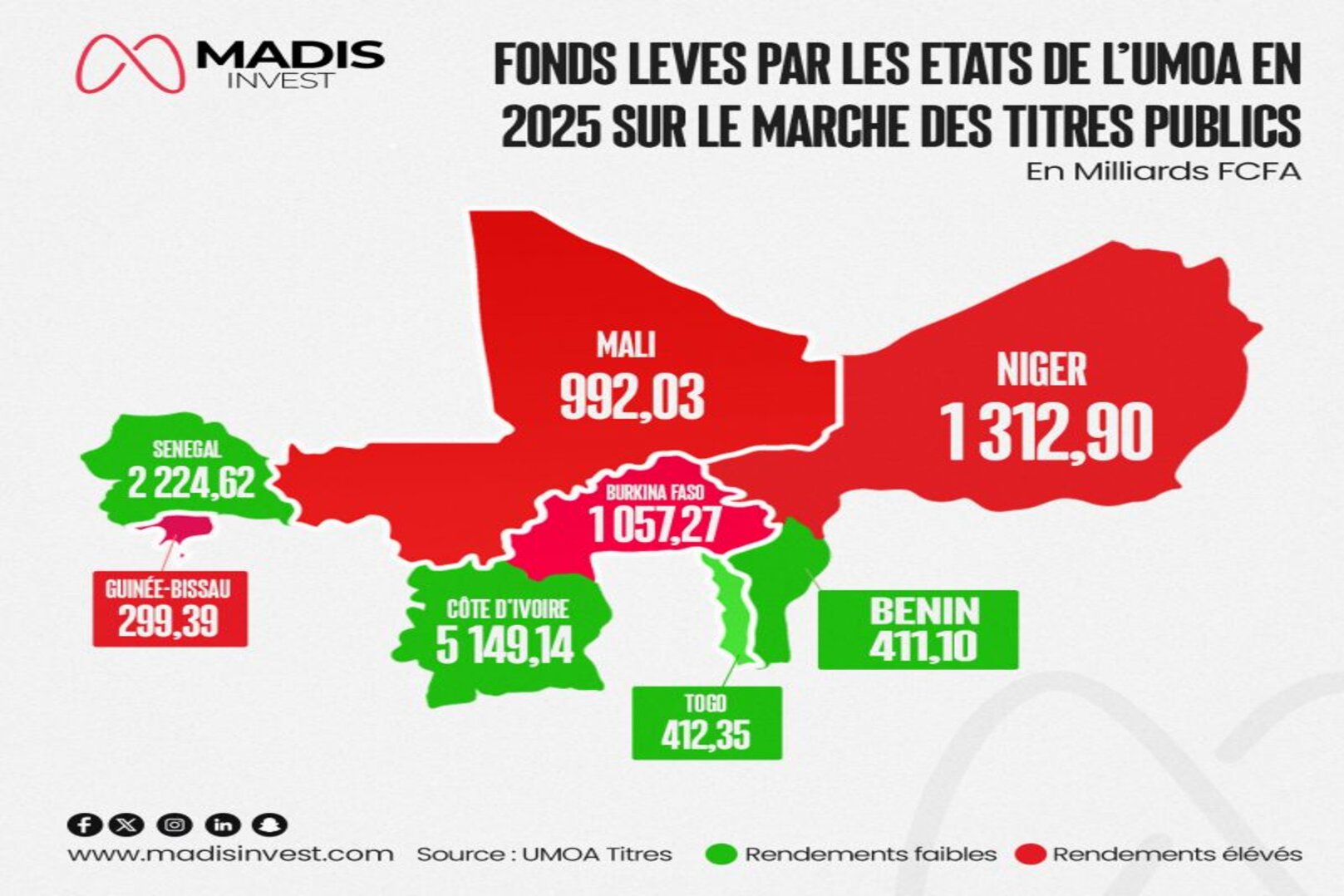

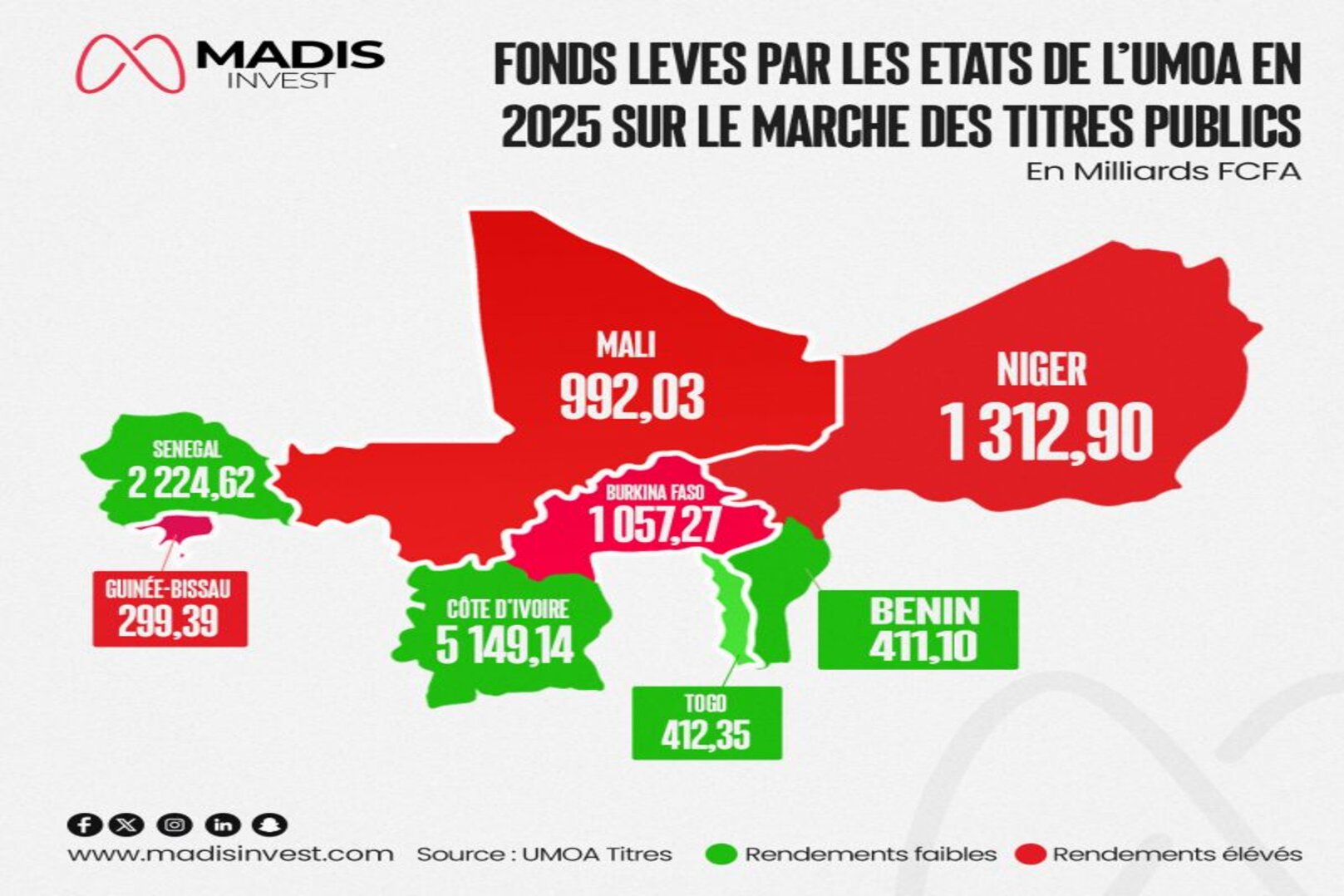

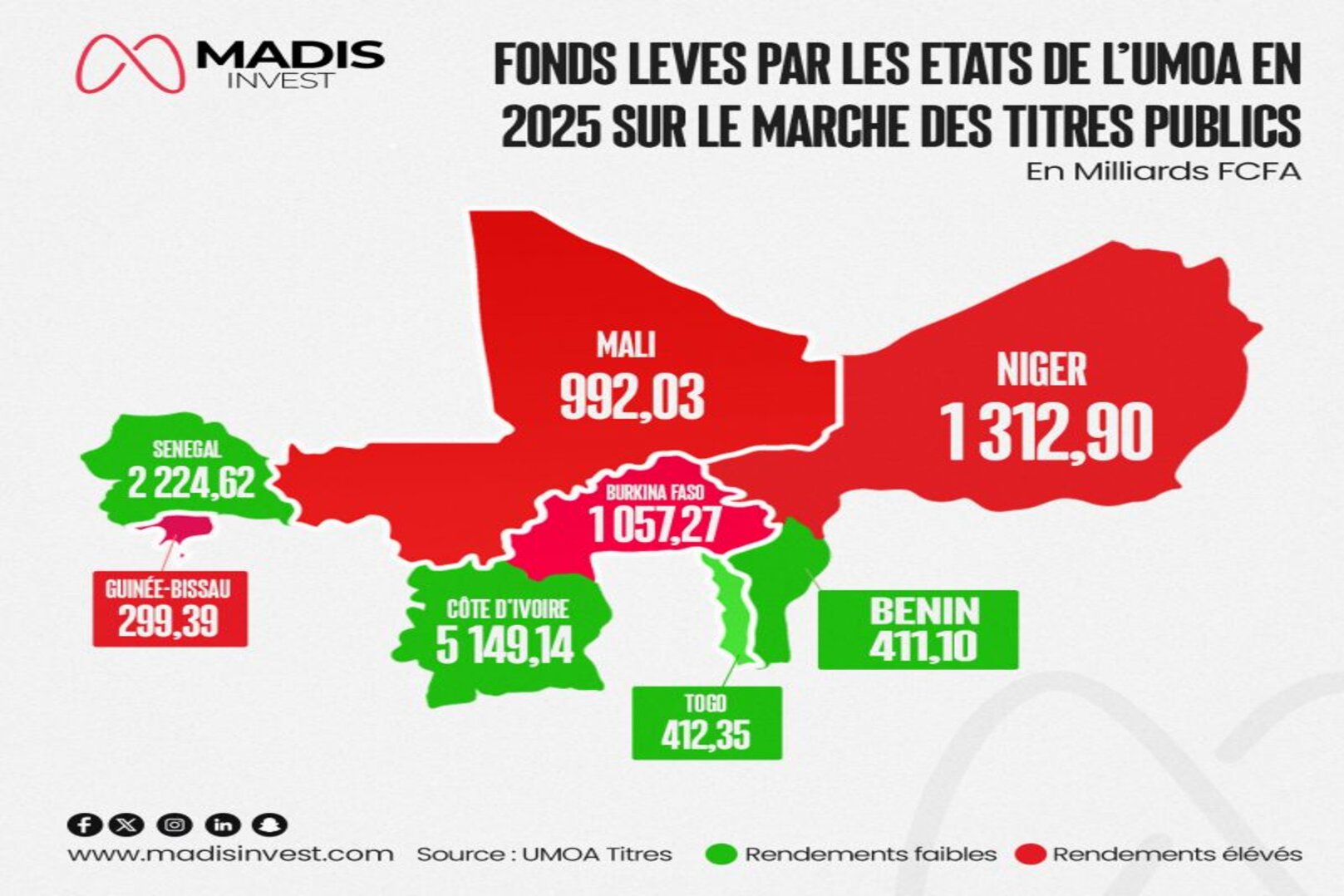

WAEMU: Côte d’Ivoire Leads Public Securities Issuances in 2025

In 2025, the member states of the West African Economic and Monetary Union (WAEMU) mobilized nearly 12,000 billion CFA francs to finance their national budgets. Among them, Côte d’Ivoire stands out, accounting for 43% of the funds raised, or 5,149.14 billion CFA francs.

This strong performance is primarily driven by the issuance of long-term Treasury Bonds (OATs), with attractive rates ranging between 6% and 7%, reflecting investor confidence in the Ivorian economy.

Senegal and Benin also performed well on the market, borrowing under comparable conditions. In contrast, Mali, Burkina Faso, Niger, and Guinea-Bissau need to offer yields above 10% to attract capital, due to higher perceived risks or more challenging market conditions.

This trend not only highlights the strength of Côte d’Ivoire’s public securities market but also underscores the relative attractiveness of certain WAEMU countries for regional and international investors.